boulder co sales tax 2020

The total sales tax rate in any given location can be broken down into state county city and special district rates. You can print a 8845 sales tax table here.

Transportation Mobility City Of Boulder

Base Period Sales from July 1 2018June 30 2020.

. The Boulder Sales Tax is collected by the merchant on all qualifying sales. Current 20212022 Tax Years. Brighton CO Sales Tax Rate.

This table shows the total sales tax. The December 2020 total local sales tax rate was 8845. CO Sales Tax Rate.

September 2021 Revenue Report. Boulder County 0985 TOTAL Combined Sales Tax Rate in Longmont. The rate is comprised of individual voterapproved county sales and use tax ballot measures adopted to support county programs in conservaon transportaon offe nder management nonprofit capital.

The Colorado sales tax rate is currently. Boulder 386 - 290 110 0985 8845. The 8845 sales tax rate in Boulder consists of 29 Colorado state sales tax 0985 Boulder County sales tax 386 Boulder tax and 11 Special tax.

Boulder CO 80306-0471 New as of Jan 4 2021 Monday thru Thursday Hours. Longmont Sales Tax Division 350 Kimbark St Longmont CO 80501. The minimum combined 2022 sales tax rate for Boulder Colorado is.

Boulder in Colorado has a tax rate of 885 for 2022 this includes the Colorado Sales Tax Rate of 29 and Local Sales Tax Rates in Boulder totaling 595. The Boulder sales tax rate is. 730 am5 pm CLOSED Friday.

November 2021 Revenue Report. What is the sales tax rate in Boulder Colorado. This is the total of state and county sales tax rates.

This rate includes any state county city and local sales taxes. The December 2020 total local sales tax rate was also 4985. Retail sales tax is levied on sales purchases and leases of personal property and taxable services in the city.

Month-Over-Month Change in Retail Taxable Sales -350. Compared to December 2019 revenue including audit revenue and the additional recreational marijuana sales tax. 2055 lower than the maximum sales tax in CO.

The latest sales tax rates for cities in Colorado CO state. The Boulder County Remainder Colorado sales tax is 499 consisting of 290 Colorado state sales tax and 209 Boulder County Remainder local sales taxesThe local sales tax consists of a 099 county sales tax and a 110 special district sales tax used to fund transportation districts local attractions etc. June 2021 Revenue Report.

The Senior Tax Worker Program allows senior taxpayers to work in county offices to help pay their county taxes. The Boulder County sales tax rate is. The Assessors Office calculates the amount of those taxes determines property values and handles property tax exemptions for seniors and disabled veterans.

The latest sales tax rate for Boulder County CO. This rate includes any state county city and local sales taxes. May 2021 Revenue Report.

To manage your Colorado sales tax account file returns and pay state-collected sales taxes online. December 2021 Revenue Report. City of Longmont Sales and Use Tax.

Boulder CO 80306-0471 New as of Jan 4 2021 Monday thru Thursday Hours. The current total local sales tax rate in Boulder CO is 4985. Boulder CO Sales Tax Rate.

The COVID-19 pandemic resulted in significant business shut-downs in the final week of March 2020 and all of April 2020 and May 2020. Sales Tax Calculator Sales Tax Table. The Colorado state sales tax rate is currently.

Did South Dakota v. Twitter Living In Arizona Arizona City Prescott Valley. For information related to specific tax issues for state county or RTD please contact the State Department.

Colorado Department of Revenue Sales Tax Division 303-238-7378 Boulder County Office of Financial Management Sales Use Tax 303-441-4519 Sales Tax Boulder Countys Sales Tax Rate is 0985 for 2020. Colorado has a 29 sales tax and Boulder County collects an additional 0985 so the minimum sales tax rate in Boulder County is 3885 not including any city or special district taxes. In areas with few sales the Assessor is allowed to use comparable sales going back up to five years.

Sales tax licenses are required from both the city and state for businesses to operate in the City of Boulder. Higher sales tax than 89 of Colorado localities. Colorado CO Sales Tax Rates by City.

This is the total of state county and city sales tax rates. 3 County voters were asked about a proposal to make improvements to the now 30 year old County jail and its programs. Prior 20192020 Tax Years.

Box 791 1136 Alpine Ave Boulder CO 80304 bouldercoloradogov O. July 2021 Revenue Report. Senior Tax Worker Program.

August 2021 Revenue Report. 2020 BOULDER COUNTY SALES USE TAX The 2020 Boulder County sales and use tax rate is 0985. Accounting records must be retained by the collecting entity for three years from the date of filing and paying a return.

State of Colorado Boulder County and RTD taxes are remitted to the State of Colorado via the Colorado Department of Revenue. Broomfield CO Sales Tax Rate. March 1 2021.

2020 rates included for use while preparing your income tax deduction. The latest sales tax rate for Boulder CO. Boulder Sales Tax Rates for 2022.

The 2018 United States Supreme Court decision in South Dakota v. The County sales tax rate is. The 2022 sales tax rates for taxing districts in Boulder County are as follows.

To fund the improvements the County Offender Management Sales Tax would be raised by 185 for five years beginning in 2020 the same year as the Flood Sales Tax in the same amount expires. The Boulder County Remainder Sales Tax is collected by the. Sales tax is due on all retail transactions in addition to any applicable city and state taxes.

December 2020 retail sales tax revenue was. For tax rates in other cities see Colorado sales. 20192020 Comparable Sales 20192020 Non-Residential Sales Comparable Residential Sales Mapping Tool Base Period Sales from July 1 2016June 30 2018.

October 2021 Revenue Report. Wayfair Inc affect Colorado. 2020 rates included for use while preparing your income tax deduction.

The Boulder Colorado sales tax is 885 consisting of 290 Colorado state sales tax and 595 Boulder local sales taxesThe local sales tax consists of a 099 county sales tax a 386 city sales tax and a 110 special district sales tax used to fund transportation districts local attractions etc. What is the sales tax rate in Boulder County. The minimum combined 2022 sales tax rate for Boulder County Colorado is.

You can find more tax rates and allowances for Boulder and Colorado in the 2022 Colorado Tax Tables. 1340 Meadow Ave Boulder CO 80304-1507 is a single-family home listed for-sale at 6000000. County and city taxes.

Sales Tax Breakdown. 2020 rates included for use while preparing your income tax deduction.

2550 Balsam Dr Boulder Co 80304 4 Beds 3 5 Baths House Prices Guest Bedrooms Bouldering

Is Expanded Outdoor Dining On Boulder S West Pearl Here To Stay

Construction Use Tax City Of Boulder

Community Culture Resilience And Safety Tax City Of Boulder

How To Sync Your Vrbo And Airbnb Accounts To Vr Calendar Sync Vr Calendar Sync Calendar Sync Calendar Sync

14000 Calle Real Goleta Ca 93117 Mls 19 520 Zillow Home Luxury Estate Image House

Armco Rebrands As Aces Quality Management Send2press Newswire Risk Management Financial Institutions Consumer Lending

Moving To Boulder Boulder Co Relocation Homebuyer Guide

Boulder Luxury Real Estate For Sale Christie S International Real Estate

Sales And Use Tax City Of Boulder

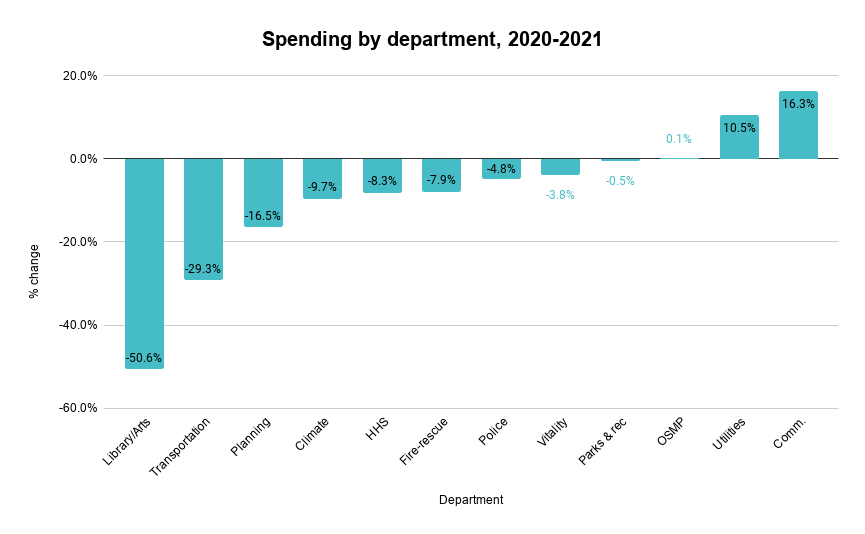

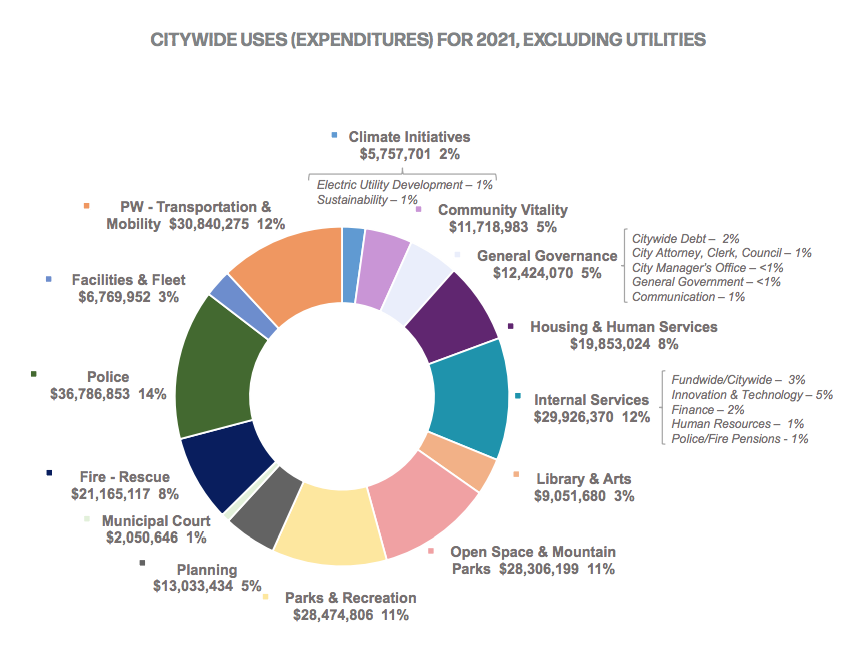

Boulder S 2021 Budget Is 7 7 Smaller With 70 Fewer Jobs Boulder Beat

Boulder S 2021 Budget Is 7 7 Smaller With 70 Fewer Jobs Boulder Beat

Summerlin A Master Planned Community In Las Vegas Nv Amenities Maps Community Master Planned Community How To Plan Las Vegas

Taxes In Boulder The State Of Colorado

Boulder On Tobacco Bans Flavored Nicotine Ups Legal Age And Asks Voters To Decide On Tax Colorado Public Radio

Access To Land Boulder County Land Lease Program National Farmers Union

Petition Stop Use Of Proctorio At Cu Boulder Over Privacy Concerns Change Org